Your insurance policy service provider will certainly consider the variety of years you've been driving and also your driving record over the last few years. This will certainly assist figure out any type of adjustments in your costs. As you gain experience and also continually drive without accidents or tickets, you're more probable to see a decrease in your car insurance coverage prices - money.

Automobile insurance coverage prices are established by the amount of threat a motorist positions to an insurance firm. suvs. This threat is identified by typical vehicle driver stats. Insurance provider wish to protect themselves, so they bill a greater rate for vehicle drivers who are most likely to get involved in a crash, sue, or get a relocating offense (cheapest auto insurance).

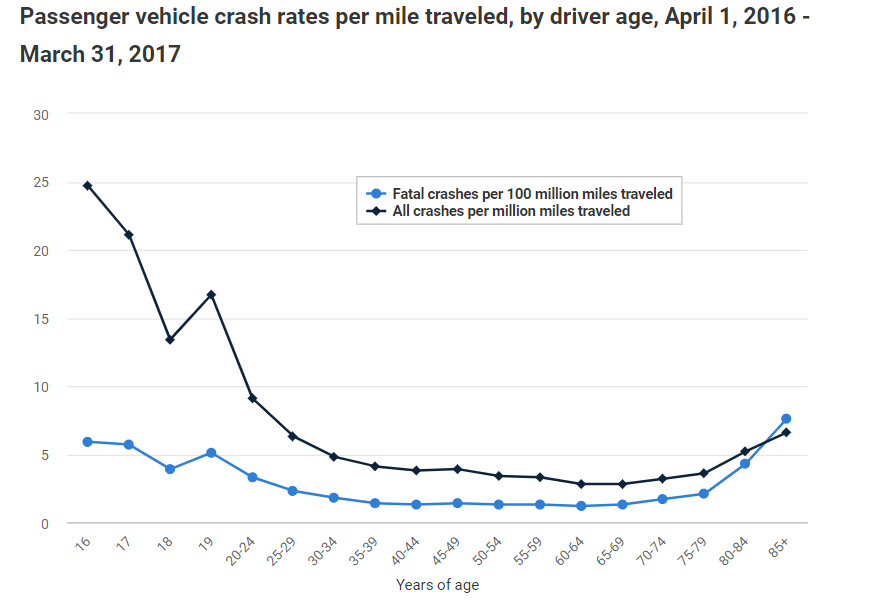

16- to 19-year olds are almost 3 times much more likely to be in a deadly collision than vehicle drivers age 20 and older., you can still go shopping around for prices within your spending plan.

liability vehicle insurance cheapest car insurance cheapest auto insurance

liability vehicle insurance cheapest car insurance cheapest auto insurance

To save cash on auto insurance, several households take into consideration enrolling teens in risk-free driving programs or vehicle drivers ed programs. These programs are developed to inform chauffeurs when they are succeeding, along with where to make changes to boost security - insure. The majority of insurer supply discounts to teens that complete these programs efficiently as well as show indicators of secure, liable driving. cheap insurance.

Facts About Will Car Insurance Decrease If My Car Is Paid Off? Uncovered

The price of auto insurance coverage differs by age and also state, so you need to do your study to learn what you can expect from your insurance costs as you grow older (cheaper auto insurance). We recommend getting several quotes to compare your cost choices (insurers). Utilize our tool listed below or call us at What Else Impacts Your Automobile Insurance Coverage Price? In enhancement to age as well as driving background, right here are some various other points that can influence typical automobile Visit the website insurance coverage prices: Sex Area Marital standing Credit history Kind of cars and truck you're guaranteeing Safety and security attributes on your lorry While many factors like age as well as gender are out of your control, there are still numerous things that might certify you for lower prices.

On the various other hand, international as well as deluxe cars are taken into consideration a high-risk for cars and truck insurance policy business because parts are expensive. Many motorists see reductions in cars and truck insurance policy rates after they acquire more driving experience, prevent getting tickets, as well as prevent mishaps.

All of it depends on the amount of driving experience you have and also exactly how lengthy you maintain a safe driving record. If you get your certificate right when you turn 16 as well as keep a clean driving document for a few years, you ought to start to see reduced prices when you reach your mid-20s - insurance company.

This two-year driving background might not be long enough to prove to insurer that you have lowered your risk. To maintain a tidy driving document, keep these secure driving ideas in mind: Limit the number of various other teen passengers as well as distractions. Never ever drive with your phone in your hand or while eating (cheaper cars).

What Affects Car Insurance Premiums - State Farm® for Beginners

See to it you're certified in your city. Our Recommendations For Automobile Insurance Policy No matter your age, you must search to locate the ideal auto insurance coverage rates. Each business supplies its very own advantages and value, so it depends on you to choose what you require from your insurance policy provider. We evaluated the top insurance coverage providers in the country to figure out which is the most effective in client fulfillment, sector online reputation, rate, protection alternatives, price cuts, as well as extra.

Some companies, such as Nationwide and Progressive, offer extra appealing price cuts when you turn 25, but this is not the norm. Vehicle insurance coverage prices are usually higher for young vehicle drivers, so looking around is an excellent concept since service providers supply differing prices. It isn't surprising, though, that many people believe 25 is when insurance policy prices decrease. cheapest auto insurance.

Although lots of people believe that 25 is the age when cars and truck insurance coverage rates decrease, the most considerable decreases occur when drivers transform 19 as well as 21. Fees proceed to decrease until you turn 30 after that, they have a tendency to continue to be roughly the very same. The only time premiums begin to boost once more will certainly be when you end up being an elderly driver.

car insurance low cost cheaper car insurance auto insurance

car insurance low cost cheaper car insurance auto insurance

According to the National Highway Web Traffic Security Administration, male vehicle drivers are more probable to be associated with casualties as a result of speeding and also drive autos that set you back even more to insure (cars). An FBI record additionally found male drivers are twice as likely to be apprehended for extreme driving violations like DUIs (car insurance).

The Best Guide To My Car Insurance Premiums Don't Go Down Every Year

cheap car cars trucks car

cheap car cars trucks car

This is mainly since more youthful motorists are statistically a lot more vulnerable to entering a mishap while when driving (insurers). Because of a high variety of insurance claims, they set you back the insurer extra cash in residential property damages and also clinical bills. With time, young drivers tend to get more experience behind the wheel, which results in the insurance costs gradually reducing.

Furthermore, age is no more taken into consideration a variable that can influence automobile insurance policy rates. That is until one turns 65 years old and the costs begin to climb as soon as again, mainly because older people are likewise viewed as a higher danger. Exactly how Much Does Your Cars And Truck Insurance Coverage Decrease When You Transform 25? While it holds true that younger chauffeurs have to pay even more for car insurance coverage, that is not the only element that influences the prices.

In reality, some young vehicle drivers who have currently transformed 25 will not see any kind of adjustments at all in regards to their insurance policy premiums, regardless of the advantages that transforming 25 years old brings. It is since they could come under the following categories: Unskilled Vehicle drivers Regardless of just how old you are, your driving experience comes first (insurance companies).

insurance companies cheap prices accident

insurance companies cheap prices accident

25-year-old vehicle drivers that simply obtained their vehicle driver's license a year ago are additionally mosting likely to be thought about inexperienced by the insurance supplier (affordable car insurance). They will pay higher costs than a 25-year-old who obtained a permit at 15 and has been driving for a years. In both scenarios, the insurance company is not going to consider the age of the applicants but instead the years of driving experience they have.

How At What Age Do Car Insurance Rates Go Down? - Money ... can Save You Time, Stress, and Money.

This is wonderful information for all women motorists available looking for a cut in their automobile insurance coverage costs. Nonetheless, the space is not that wide when it comes to what male and female chauffeurs need to pay before they turn 25. Contrasted to the difference that 18-year-old males as well as 18-year-old women pay (11%), or also the distinction between what 23-year-old males and also 23-year-old females pay (6.