If you live in an area with frequent negative climate, you may want to select a lower comprehensive insurance deductible to limit what you pay out of pocket. At the exact same time, you can maintain your collision insurance deductible greater to stabilize out your vehicle insurance policy costs.

In that case, your automobile insurance costs would set you back more to balance out the $0 auto insurance coverage deductible - vehicle insurance. When Do You Pay A Car Insurance Policy Deductible? Below are the primary circumstances in which you 'd be accountable for paying a deductible: If you create an auto crash and your automobile requires repair work, you'll pay your insurance deductible on your accident protection - dui.

insure affordable car insurance car car insured

insure affordable car insurance car car insured

Just how To Pick An Auto Insurance Insurance Deductible Now that you understand what an automobile insurance coverage deductible is, it is essential to select the best deductible for your scenario - credit score. You should pick a high vehicle insurance coverage deductible if you wish to reduce your monthly bill and if you have the capacity to pay it (cheap insurance).

If you do not have any kind of financial savings, it's not a wise idea to have a high deductible. You could be the most effective chauffeur in the world, yet you still share the roadway with negative drivers as well as uninsured vehicle drivers (car insurance). According to the Insurance Coverage Info Institute, about 6 percent of vehicle drivers that had accident coverage sued in 2018.

You can always choose a lower insurance deductible while you conserve up a reserve and after that elevate the insurance deductible later on. You ought to choose a low car insurance coverage deductible if you do not have the ability to pay a high one, or if you wish to protect your out-of-pocket prices. A low deductible might be an excellent concept if you Click here! reside in a congested area where you have a higher possibility of experiencing an accident (car).

cheapest car insurance cheap auto insurance business insurance credit

cheapest car insurance cheap auto insurance business insurance credit

Some programs will certainly reset your deductible to the full amount after you make a case, as well as others will reset it to a smaller sized amount - low cost. After 5 years, you would have paid an added $100 or more to your insurance firm.

5 Easy Facts About Understanding Car Insurance Deductibles - Policygenius Explained

What Takes place If You Can't Pay Your Deductible? When paying out an insurance coverage case, your insurance provider will frequently compose you a look for the amount it is accountable for covering - liability. If you are not able to pay the rest of your costs for the insurance deductible, you might have some choices. car. Below are some steps you can take if you can't manage to pay your deductible: It could be rewarding to speak to your mechanic concerning repayment alternatives after an accident.

Recognizing when to adjust your deductible as well as when to search for a new automobile insurer with affordable rates is the safest method to stay clear of high costs in the future. Our Referrals For Vehicle Insurance Coverage Searching for automobile insurance does not need to be challenging. Simply make certain to get quotes from multiple carriers, so you can compare rates.

cheapest auto insurance cars cheap car auto insurance

cheapest auto insurance cars cheap car auto insurance

An insurance deductible is the amount you are required to pay out of pocket when filing an insurance coverage claim. You possibly spoke about them when you initially acquired your insurance policy protection (low cost). Yet if you don't examine your insurance every year, the next time you also listen to the word "deductible" might be months or even years later on when you're submitting an insurance claim.

car auto insurance auto cheaper cars

car auto insurance auto cheaper cars

In these instances, the comprehensive insurance deductible will apply. You might see that some insurance coverages don't need a deductible, like arranged insurance coverage for fashion jewelry or other beneficial items, as well as house owners' or automobile liability insurance coverage. In these instances, you will not have to pay any expense costs if you need to submit a claim.

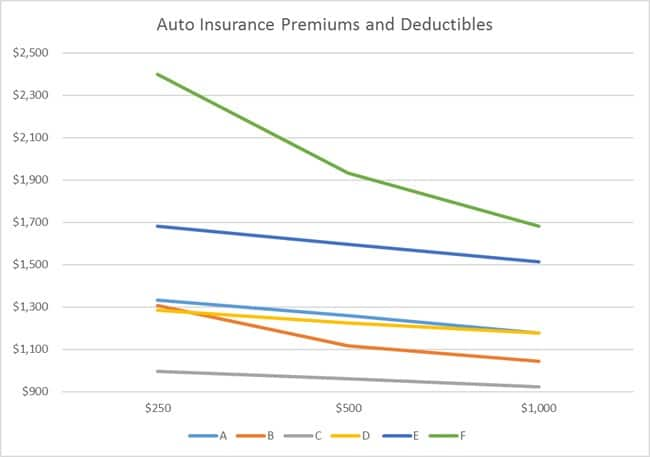

Deductibles additionally influence your rates. The higher the insurance deductible, the reduced your premium.

For circumstances, if you've got a fairly new residence, you might not have the same dangers as an older house and also might not be as likely to submit an insurance claim. In which case, it could be better to have a higher insurance deductible and also reduced costs. And also because various coverages within your plan contain various deductibles, your premium and deductibles can come to be a lot more customized.

Rumored Buzz on Understanding Your Insurance Deductibles - Iii

Your insurance agent is the best individual to chat to when making these decisions., for help assessing your deductibles as well as guaranteeing that you're paying the appropriate quantity for your present dangers.

car insurance insurance companies vehicle auto insurance

car insurance insurance companies vehicle auto insurance

For specific coverage information, always describe your plan. If the plan insurance coverage descriptions in this post conflict with the language in the plan, the language in the plan applies.

Just how Does an Insurance Policy Insurance Deductible Work? You select the amount of your insurance deductible when you purchase your automobile insurance plan.

For picture objectives, right here is how car insurance deductibles job: You acquire a policy with a $500 deductible. If you enter an accident or other protected event you will certainly require to pay the $500 deductible before the insurer starts paying for the rest. Deductible quantities vary, however comprehending the benefits as well as downsides to choosing a lower or greater amount will certainly aid you make your choice on what is the best fit for your requirements - cheaper cars.