If somebody chose for no deductible when purchasing coverage Insurance companies may enable people to decide for protection with a $0 deductible. If somebody has no insurance deductible, they will not owe anything out of pocket when a covered incident happens.

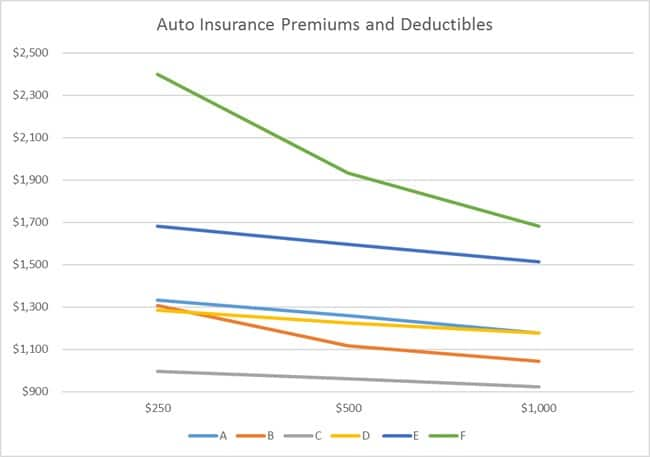

Usually, motorists need to pick an insurance deductible for extensive coverage, collision coverage, and accident security. What's the average vehicle insurance coverage deductible? The average auto insurance coverage deductible is $500. Individuals can pick an insurance deductible amount anywhere from $0 to $2,000 with many insurers. Exactly how a lot of an insurance deductible should I pick for my auto insurance? The goal when getting an vehicle insurance quote is to obtain high quality and cost effective insurance policy.

cheapest car insurance auto insured car cheap

cheapest car insurance auto insured car cheap

Right here are some key considerations. Threat resistance, When selecting a plan with a greater deductible, people take a bigger risk. They're betting that they will not require to make an insurance claim and pay out-of-pocket expenditures. Those that aren't comfortable taking that chance might intend to pay greater costs to pass more of the threat of financial loss on to their insurance coverage supplier.

Those who have a tendency to have little money conserved for unexpected expenses might intend to pick a lower insurance deductible. Individuals with a large emergency situation fund can most likely pay for to gamble of sustaining higher out-of-pocket prices if they make an insurance policy claim. The likelihood of a claim, The more probable it is a person will certainly make a case, the lower they ought to establish their insurance deductible.

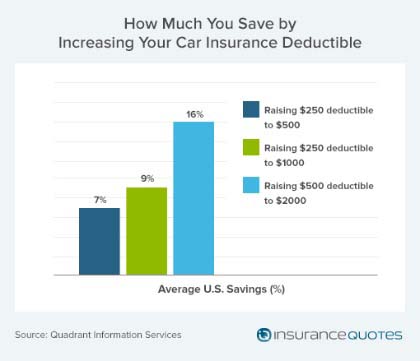

Yet if the chances of a protected occurrence are not likely, a motorist may be far better off maintaining their costs reduced. Some individuals can conserve around $220 every year on comprehensive and crash insurance coverage by changing from a policy with a $50 insurance deductible to one with a $250 deductible. By placing the premium financial savings into a checking account, an individual could have adequate cash in around a year to cover the included insurance deductible amount (prices).

Deductible - Direct Auto Insurance Can Be Fun For Anyone

As long as a chauffeur does not enter into a mishap in less than a year, they would certainly be far better off. accident. The worth of the automobile, If a car isn't worth a lot, it might not pay to have coverage with a high insurance deductible. Claim a motorist goes with collision coverage with a $1,000 deductible and also their car is only worth $1,000.

In this case, the driver would certainly be far better off passing up collision protection completely. Just how to stay clear of paying a car insurance deductible, The finest way to avoid paying an automobile insurance policy deductible is to stay clear of accidents, burglary, or damage. Method defensive driving, comply with the customary practices, obey the speed restriction, as well as avoid driving in poor weather.

People can likewise pick a policy with no insurance deductible, albeit at a higher price. Or they can register for a disappearing or vanishing insurance deductible with insurance companies that supply it. This will certainly lower the amount of the deductible by a collection quantity during each time period the vehicle driver is cost-free of mishaps - credit score.

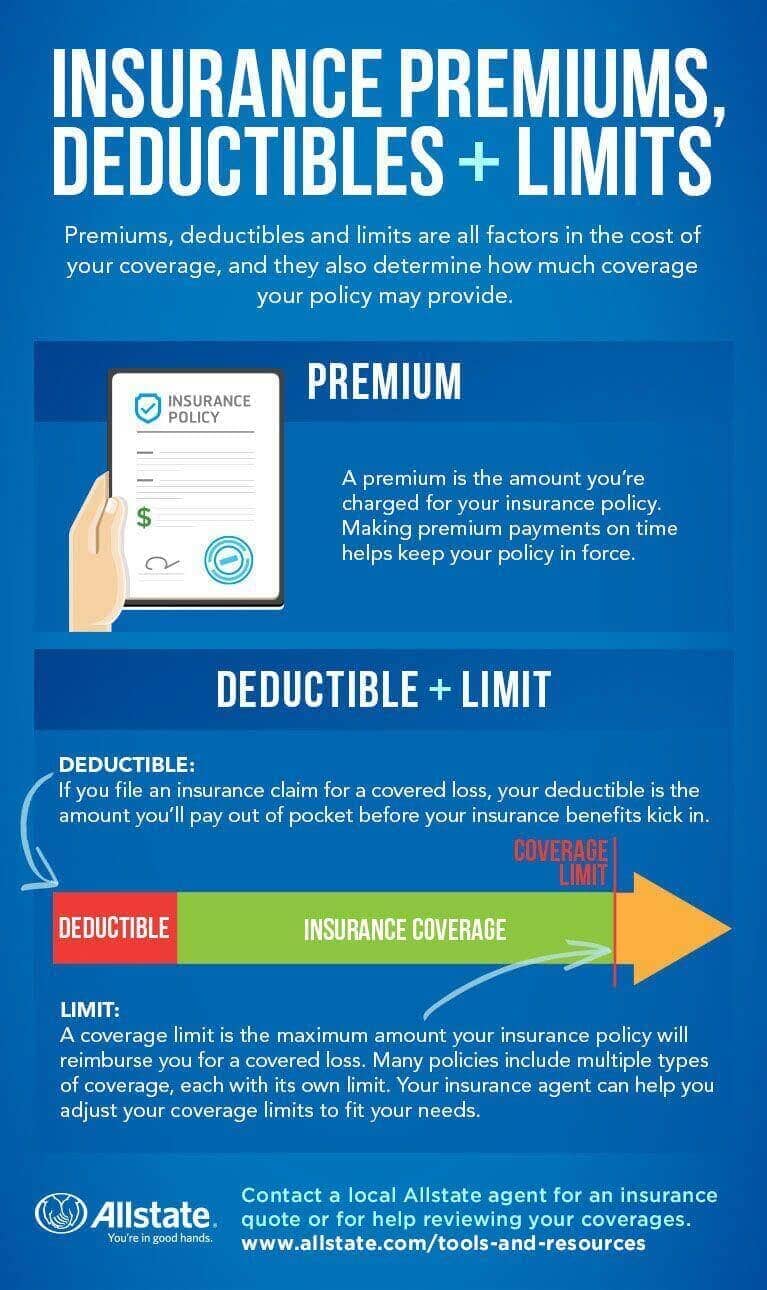

We are so pleased you asked! This is an important question one that many individuals respond to when and also never quit to revisit as their circumstances alter. What is an insurance policy deductible? An insurance policy deductible is the quantity of money you have to pay from your own pocket before your insurance policy protection kicks in.

Raising it from $500 to $1,000 could produce a 14 percent savings. Again, these are simply quotes. When it comes to residence insurance coverage, cost savings can also be substantial. This New york city Times piece records that elevating a Massachusetts home insurance deductible from $500 to $2,000 could conserve as high as 20 percent or even more.

Some Known The original source Facts About High Or Low Car Insurance Deductible - Compare.com.

vehicle car insurance car insurance cheapest car insurance

vehicle car insurance car insurance cheapest car insurance

As well as if you don't have to file a case for two, three, or 4 years you could conserve a substantial quantity of cash over time. (FYI: the average vehicle owner drives for 8.

Exist other means to save cash on insurance coverage? Yes! We have actually listed a few of one of the most usual insurance price cuts below. Other options consist of added security procedures or home updates like a security system, an emergency situation generator, a brand-new roofing, new electric or pipes systems. As constantly, we like to remind people that insurance policy is an extremely personalized topic.

What is accident coverage? Collision coverage helps pay for the cost of fixings to your car if it's struck by an additional automobile. It might also assist with the price of repair services if you struck an additional lorry or item. That means you can utilize it whether you're at mistake or otherwise.

That indicates it would not pay for damages to another person's automobile or property (cheap car). Collision likewise doesn't cover all damage to your lorry. Instances of problems not covered are: Theft Vandalism Floods Fire Hitting an animal If you wish to recognize more concerning protection for these sort of damages, take a look at the extensive insurance coverage page.

A collision insurance deductible is the amount you've concurred to pay before the insurance coverage firm begins paying for problems. Typically, the more risk you're eager to take (greater deductible), the reduced your insurance coverage price would be.

The Only Guide for $500 Or $1000 Auto Insurance Deductible? - Policy Advice

Let's state you're involved in an accident that causes $1,000 in damages to your car and you have a $250 insurance deductible on your accident coverage. You'll pay the initial $250 in damages, typically to the body store, and also then your insurance policy will certainly pay the remaining $750 (cheap car). The above is meant as general info and as basic plan descriptions to assist you recognize the various types of coverages.

When you purchase cars and truck insurance, you'll have to make several options concerning your insurance provider and also optional protections. You'll likewise have to choose your insurance policy deductible, which can be more tough than it seems. Should you attempt to conserve money by picking a higher insurance deductible or really feel even more protected by opting for a reduced one? To select the appropriate deductible for you, you'll require to consider your driving history, your emergency fund, and the costs of various deductibles, in addition to a number of other variables.

Key Takeaways Your insurance deductible is the portion of costs you'll spend for a protected case. Evaluate your car's worth, your reserve, as well as the prices of protection when picking an insurance deductible. Picking a higher insurance deductible might assist you conserve money on costs, however this implies you'll have to pay more expense after a crash.

car insurance cheaper car car insurance vehicle

car insurance cheaper car car insurance vehicle

In some states, you might also have a deductible for:: Pays to fix your automobile after damages caused by a driver without insurance or without sufficient coverage.: Pays your medical bills when you have actually been harmed in an accident.: Covers the costs of some mechanical repair services, similar to a warranty - insurance.

Whether you pay a deductible after an event relies on your coverage, who is at fault, your insurer, and your state's legislations. risks. In The golden state, you might qualify for an insurance deductible waiver on your collision coverage, which indicates your insurance provider will pay the insurance deductible if an uninsured driver hits you.

Getting My Automobile Insurance - Official Website To Work

How Does a Deductible Work? Think of a tree branch falls on your vehicle and also triggers damage. You sue on your comprehensive protection and also the service center estimates it will certainly set you back $1,000 to fix. What you'll pay depends on your insurance deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the cost of fixing the damage coincides or almost the very same as your insurance deductible, you may choose not to file an insurance claim since you would certainly lose any type of claim-free discount rate - car insured.

When Do You Pay a Deductible? In the scenario above, with a $500 insurance deductible, the insurance policy firm would certainly pay the vehicle repair shop $500, and you 'd be expected to pay the other $500. laws.

As the car's worth comes down, the opportunity of a complete loss goes upmeaning it may not be worth getting optional insurance coverages. The Kansas Insurance Department recommends carrying just liability insurance coverage on automobiles worth less than $3,000.

Various Other Concerns to Ask When Picking Deductibles While the three aspects above are the most critical when choosing an insurance deductible, you'll intend to ask these questions, too. Exists a Required Minimum Deductible? It depends upon your insurance firm and state. vehicle insurance. Numerous insurance coverage deductibles start at $250 or $500, but some insurance firms supply a $0 deductible alternative for specific insurance coverages, and others may require higher-risk chauffeurs to carry greater deductibles.

Can You Use Various Other Insurance Policy to Cover the Prices of Injuries? In some states, you might be able to use wellness coverage to pay the costs of injuries due to vehicle mishaps rather than counting on automobile insurance coverage, such as clinical payments or PIP insurance. In this case, you might select a higher insurance deductible or a reduced limit on those protections, which would conserve you money. cheap insurance.

Fascination About Should I Raise My Auto Insurance Deductible? - Coverage.com

dui car insurance auto insurance credit score

dui car insurance auto insurance credit score

If your car is currently at the service center, you could get a financing to pay the deductible or ask the store to hold your car until you can locate some money. What Is the Highest Possible Deductible for Auto Insurance Policy? The highest possible deductible available to you depends upon your state and your insurer, but Mc, New bride said an ordinary high deductible is around $1,000.

For specialized vehicles or antiques, they can get to $5,000 to $10,000. What Is the Ordinary Deductible for Auto Insurance? No national standard throughout states and insurers has actually been published, yet Progressive claims $500 is one of the most typical insurance deductible picked by its insurance holders.

Note, your cars and truck's real money worth thinks about the cost of your auto when you purchased it, as well as the age as well as problem it remains in at the time of the mishap. How do I choose a deductible? It is very important to select an insurance deductible that you fits your monetary scenario. insurance.

insured car cars cheaper car auto insurance

insured car cars cheaper car auto insurance

On the other hand, if you do not have enough cash to cover your deductible in case there's covered damage to your lorry, you might have problem getting your vehicle dealt with. To select the ideal quantity, think regarding just how much you could pay out-of-pocket to have your auto repaired without experiencing a whole lot of financial stress and anxiety in your life.

00 deductible. This implies you are responsible for paying the first $500.

An Unbiased View of Who Pays The Deductible In A Car Accident? - Anidjar & Levine

Have concerns regarding your existing deductible or readjusting it? Offer us a phone call at or quit by a Straight Car Insurance policy location near you - automobile.

Your car insurance coverage deductible is the quantity of money you 'd add when your insurance coverage company pays for a covered case (insure). Exactly how do car insurance deductibles work?

Anytime you're in a car mishap and also there are damages to your auto that would certainly be covered under detailed or collision coverages, you'll be responsible for paying the insurance deductible under each of those coverages. If you have numerous cars and trucks on your vehicle insurance policy, you can also pick different deductibles for each vehicle.